In the tungsten carbide industry, finding the right suppliers can make or break your business. Whether you're a manufacturer looking for reliable raw material sources or a trader trying to build a global supply network, understanding what type of supplier you're dealing with is the first step toward smarter purchasing decisions.

(Image Source: amanatool.com)

I've worked for about five years in a trading company that specializes in tungsten carbide tools and wear parts. Our company had its own factory, but since our product range was quite broad, it wasn't possible to produce everything in-house. For many products, we had to work with external suppliers. Although my position wasn't in purchasing, I learned a lot from our procurement colleagues, such as how they selected, evaluated, and handled different types of suppliers. Those experiences gave me valuable insight into the real challenges behind sourcing in this industry.

Then, let's discuss supplier types from two main perspectives:

- Qualification and performance levels;

- Cooperation value and risk relationship.

In practice, supplier evaluation always needs to be applied to specific product categories. The requirements for carbide blanks, cutting tools, wear parts, or mining components can be very different.

If you want a clearer overview of how tungsten carbide suppliers are typically grouped, you can start from this supplier category overview , and then apply the evaluation logic discussed below to each category.

You'll also find practical advice on how purchasing managers can develop strategies for each supplier type in the tungsten carbide industry.

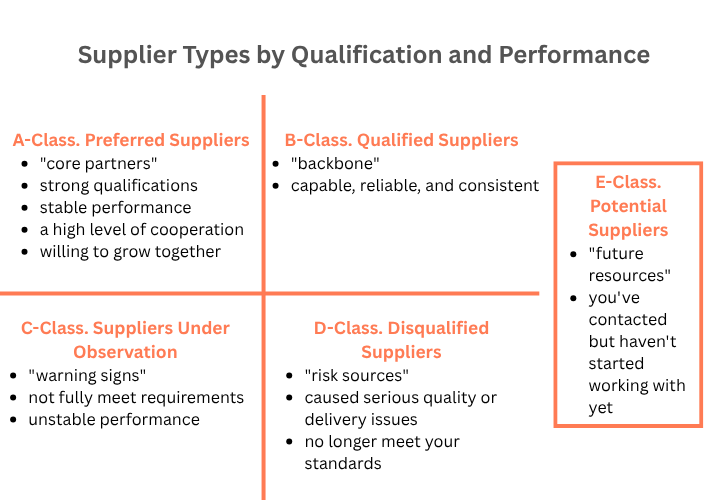

1. Supplier Types by Qualification and Performance

Based on a supplier's capability (such as quality systems, product certifications, and technical expertise) and real performance (delivery, cooperation, and consistency), we can classify them into five major categories.

A-Class. Preferred Suppliers

These suppliers have strong qualifications and stable performance. They show a high level of cooperation and are willing to grow together with your company.

Management Strategy:

- Involve them in new product development projects first.

- Even if their prices are slightly higher, prioritize them.

- Build long-term partnerships that include information and technology sharing.

A-class suppliers are your "core partners", the ones you build mutual trust and shared growth with.

B-Class. Qualified Suppliers

These suppliers are capable, reliable, and consistent, though not yet strategic-level partners.

Management Strategy:

- Maintain stable cooperation and involve them in some new projects.

- Evaluate regularly and identify improvement opportunities.

- If their performance keeps improving, promote them to A-Class.

B-class suppliers form the solid backbone of your supply chain.

C-Class. Suppliers Under Observation

Their qualifications might not fully meet requirements, or their performance has been unstable.

Management Strategy:

- Suspend new projects and keep only existing business.

- Ask for improvement plans and monitor the results.

- If no progress is made, plan for replacement.

C-class suppliers are "warning signs". They require close supervision.

D-Class. Disqualified Suppliers

These suppliers have caused serious quality or delivery issues and no longer meet your standards.

Management Strategy:

- Stop new cooperation immediately.

- Gradually shift existing business to qualified suppliers.

- Keep an exit record to avoid reactivation.

D-class suppliers are risk sources and should be firmly eliminated.

E-Class. Potential Suppliers

These are companies you've contacted but haven't started working with yet.

Management Strategy:

- Build and update a database of potential suppliers.

- Assess their qualifications and capacity regularly.

- Try small trial orders or sample testing when appropriate.

E-class suppliers are your "future resources", adding flexibility and competitiveness to your supply chain.

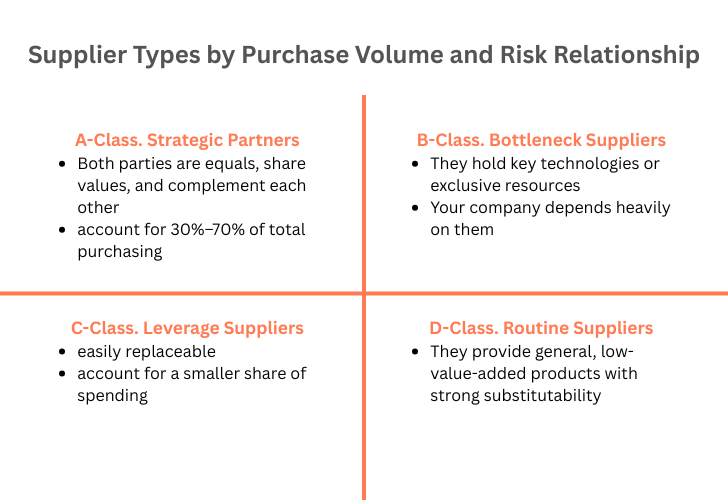

2. Supplier Types by Purchase Volume and Risk Relationship

The second perspective looks at suppliers through the lens of spending proportion and cooperation risk.

This focuses more on relationship strength and bargaining balance.

A-Class. Strategic Partners

Both parties are equals, share values, and complement each other. Usually, these suppliers account for 30%–70% of total purchasing.

Management Strategy:

- Build mutual trust and transparency.

- Consider strategic collaboration, joint R&D, or even equity cooperation.

- Focus on long-term win-win growth.

B-Class. Bottleneck Suppliers

They hold key technologies or exclusive resources, which means your company depends heavily on them.

Management Strategy:

- Maintain good relationships and ensure a stable supply.

- Develop backup options to reduce dependency.

- Offer reasonable profit margins or support to secure supply priority.

C-Class. Leverage Suppliers

These suppliers are easily replaceable in the market and account for a smaller share of spending.

Management Strategy:

- Use competition to lower costs.

- Replace unstable suppliers quickly.

- Standardize and systemize your purchasing process.

D-Class. Routine Suppliers

They provide general, low-value-added products with strong substitutability.

Management Strategy:

- Simplify procedures and batch your purchases.

- Streamline evaluation and communication.

- Focus on cost efficiency.

3. Practical Tips for Purchasing Managers in the Tungsten Carbide Industry

Build a Two-Dimensional Supplier Matrix:

Combine performance level and cooperation risk when making decisions.

For example:

- A-Class performance + Strategic relationship → Top priority cooperation.

- B-Class performance + Leverage relationship → Continuous optimization.

- C-Class performance + High risk → Plan replacement.

Dynamic Evaluation and Tiered Management:

Conduct a full supplier review at least once a year and adjust rankings based on performance.

Allocate Resources Wisely:

Share more information and opportunities with A- and B-Class suppliers, while keeping supervision and exit mechanisms for C- and D-Class suppliers.

Build a Potential Supplier Pool:

Keep searching for E-Class suppliers to maintain flexibility and healthy competition in your supply chain.

Conclusion

In the tungsten carbide industry, supplier management is not just about controlling cost. It's also about managing risk and creating value. By establishing a clear classification system, companies can define their supplier strategies more scientifically and achieve a supply chain that is steady, flexible, and win-win for all parties. If you’re building or optimizing your carbide supply chain, start with a simple question: "Do you really know what type of supplier you're dealing with?" Because the better you understand them, the smarter your purchasing decisions will be.